Strategy

Strategy, business model and value chain

Alpiq is a generator of electricity, steam and heat, and optimises its generation assets through asset trading. In addition, Alpiq is active in proprietary energy trading and origination (providing energy-related risk and portfolio management services to other generators and energy off-takers, mainly in a business-to-business context). It is represented by subsidiaries in various European countries.

The core of Alpiq’s generation portfolio is flexible hydropower generation in Switzerland. The characteristics of these generation assets make Alpiq a natural provider of flexible generation and energy storage. Besides the production stemming from the CO2-free technologies of hydropower (Switzerland), and nuclear power (Switzerland) and the small share from wind and solar (in Italy and France), Alpiq generates energy from natural gas (in Italy, Spain and Hungary). The flexible gas-fired combined-cycle and open-cycle power plants operated in Italy, Spain and Hungary strengthen system flexibility and security of supply.

Recognising its strength in operating and optimising flexible generation, Alpiq’s strategy focuses on providing flexibility to the energy system and by doing so enabling the energy transition through the integration of variable renewable energy sources like wind and solar. Alpiq is pursuing investments in flexible hydropower, BESS and flexible gas-fired thermal generation. These investments contribute to the energy transition by increasing the flexibility Alpiq can provide to the energy system. In 2024, Alpiq acquired a 30-megawatt battery project in Finland, a 100-megawatt battery project in France, and a majority stake in the Finnish hydrogen pioneer P2X Solutions.

ESRS 2 SBM-1 40 (a)

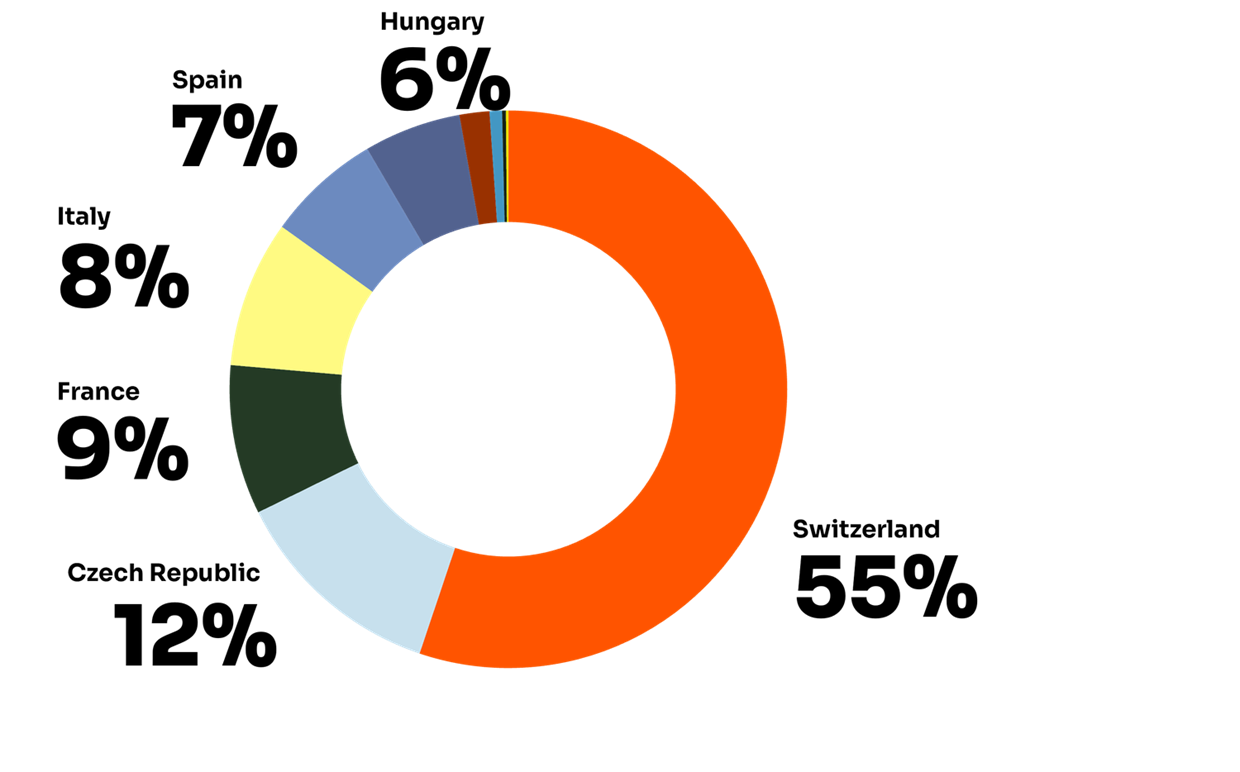

As per 31 December 2024, Alpiq has 1,385 employees, split by geographical areas as follows:

Country | Headcount of employees |

Switzerland | 764 |

Czech Republic | 174 |

France | 120 |

Italy | 118 |

Spain | 92 |

Hungary | 78 |

Germany | 24 |

Finland | 10 |

Norway | 3 |

Bosnia | 2 |

Total | 1,385 |

The following pie chart illustrates the distribution of Alpiq employees by country in 2024:

The above figures do not include employees who work for fully-consolidated Alpiq entities but do not have Alpiq work contracts, as is the case for P2X Solutions, Entegra Wasserkraft AG and Isento Wasserkraft AG employees. P2X Solutions has 18 employees in Finland, while Entegra and Isento have six and one employee(s) respectively.

Alpiq developed a new corporate strategy in 2023, in which sustainability was anchored as an integral part. The company has set the overarching goal of achieving the net-zero target for Scope 1 and 2 by 2040. The emissions path to reach this target depends to a large extent on the progress of the energy transformation and technological development and is therefore currently still under development. However, since 99% of Alpiq’s emissions stem from gas-fired combined-cycle power plants in Italy, Spain and Hungary, these plants have the highest potential for emissions reduction through optimisation / efficiency measures such as the measures that were implemented for the Vercelli plant (see the success story in the Introduction section of the Sustainability Report).

ESRS 2 SBM-1 40 (e)

Share of emissions from CCGT power plants

99%

As mentioned previously, Alpiq offers its customers comprehensive and efficient services in the fields of energy generation and market access, as well as energy portfolio management. These services are mainly offered to industrial and business customers throughout Europe. Thanks to digital tools and Alpiq’s expertise in flexibility management and cross-border trading, energy generation and asset trading are optimised to support the TSOs in stabilising the electricity grids. In addition, Alpiq operates in Trading and Origination in its core markets in Europe. In France, Alpiq has also been active in the business-to-customer retail business for electricity consumers since 2020.

While the transition towards becoming a more sustainable company may affect Alpiq’s asset portfolio, the core products / services offered, and the target customer type will remain the same. However, the markets served may be expanded depending on where future sustainability-related projects are located.

Apart from thermal assets (gas-fired power plants and nuclear power plants), Alpiq has a diverse national and international power-generation portfolio from renewable resources comprising hydropower, wind and photovoltaics. The services offered in many European countries also support large and industrial customers in selling electricity from RES assets or in their efforts to reduce the environmental footprint of their own business activities.

ESRS 2 SBM-1 40 (f)

As electrification advances across various sectors, Alpiq is driving the sustainable energy transition by making strategic investments in flexible assets, such as battery projects. The company’s CCGT power plants, which play a crucial role in maintaining system stability, will reach their end-of-life before 2040. These plants contribute to reliable power generation, which is vital for Alpiq’s customers, including TSOs. They directly influence the company’s economic performance and the security of the energy supply, which are key pillars of sustainability. However, with 99.9% of Alpiq’s total Scope 1 GHG emissions stemming from CCGT power plants, these assets remain the primary source of direct emissions. Embracing the “best owner principle”, Alpiq continuously invests in upgrading projects to enhance CCGT efficiency and explore green gas blending capabilities until the plants’ end-of-life.

ESRS 2 SBM-1 40 (g)

After having explained Alpiq’s strategy and business model, the following section focuses on the company’s value chain. As part of the DMA, which will be described in detail at a later stage (see chapter Material Sustainability Matters), Alpiq’s value chain has been analysed in detail to identify Impacts, Risks and Opportunities (IROs) created throughout the whole value chain.

It is important to note that when talking about value chain in the context of CSRD and the DMA, the term value chain is to be understood in line with the definition provided by the European Commission: “A value chain encompasses the activities, resources and relationships the undertaking uses and relies on to create its products or services from conception to delivery, consumption and end-of-life. Relevant activities, resources and relationships include: i. those in the undertaking’s own operations, such as human resources; ii. those along its supply, marketing and distribution channels, such as materials and service sourcing and product and service sale and delivery; and iii. the financing, geographical, geopolitical and regulatory environments in which the undertaking operates. Value chain includes actors upstream and downstream from the undertaking. Actors upstream from the undertaking (e.g., suppliers ) provide products or services that are used in the development of the undertaking’s products or services. Entities downstream from the undertaking (e.g., distributors, customers) receive products or services from the undertaking.” (European Commission, 2023).

This use of the term “value chain” is not to be confused with Alpiq’s internal definition and use of the term, which refers to the elements that generate value for the company and includes the “value chain elements” Assets, Trading and Origination. In order to avoid confusion with Alpiq’s internal use of the term “value chain”, these are referred to as “value chain elements” in the remainder of this chapter.

The complete Alpiq value chain looks as follows:

ESRS 2 SBM-1 42 (a),(b),(c)

As shown in above illustration, Alpiq’s own-operations part of the value chain contains the company’s three main elements of value creation – Assets, Trading and Origination – as well as activities that span across these three elements. The Alpiq value chain is completed by the upstream and downstream parts.

The upstream value chain consists of partner agreements with minority shareholdings, for both renewable and non-renewable energies. Under the partner agreements in force, the shareholders of partner power plants are required to take on the energy and pay the annual costs allotted to their ownership interest throughout the concession period. Furthermore, nuclear power plant owners are required to pay certain additional contributions to the decommissioning and waste disposal fund, in case a primary contributor is unable to fulfil payments. The partner agreements run throughout the useful life of the power plant, or throughout the concession period, and can only be terminated under exceptional circumstances and with the unanimous decision of all the parties. In some cases, the shareholding may differ from the right to energy and therefore from the obligation to pay the annual costs. In such cases, the reported interest from an economic perspective may differ from the interest held pursuant to corporate law.

In addition, Alpiq’s upstream value chain entails some Trading and Origination activities. Upstream trading entails the physical trading of power, natural gas, biogas and biomethane, while upstream origination entails mainly the engagement in power purchase agreements (PPAs) and the supply of power via third parties.

Similarly to Alpiq’s upstream value chain, the company’s own operations can be divided into activities belonging to the Asset, Trading, or Origination element, or to cross-element activities. Own-operation activities in the Asset element include power generation through renewable and non-renewable assets, as well as asset trading. The own-operation Trading element consists of the financial trading of fossil commodities, power and CO2 certificates, and the physical trading of natural gas, biogas, biomethane, CO2 certificates and power. Activities related to market access and market risk management, foreign exchange and liquidity management are also part of own-operations trading. Own-operations Origination activities include third-party asset management, risk management services, PPA solutions, sales activities to end customers, and ancillary services. Cross-activities include energy storage, support functions (IT, HR, Legal & Compliance, Security, Facility Management, Projects), asset waste management and operational waste management.

Alpiq’s downstream value chain entails primarily the business-to-business sale of power to TSOs, DSOs, industrial customers and PPA buyers, as well as to intermediaries or resellers. In addition, it includes Alpiq’s business-to-customer retail activities in France.

ESRS 2 SBM-1 42 (a),(b),(c)

Stakeholders, stakeholder engagement, and the management of stakeholder views and interests

Alpiq’s most relevant internal and external stakeholders are employees, shareholders, banks, customers, suppliers, business partners, associations, politicians and government groups, as well as civil society, including NGOs.

Stakeholder engagement has a high priority at Alpiq and takes place with all stakeholder groups via different channels and at various intensities and frequencies, depending on the specific stakeholder group and the situational circumstances. The dialogue with stakeholders, i.e. shareholders, is generally conducted via the Chairman and the Annual General Meeting. The administrative contact is the Secretary of the Board. Furthermore, public affairs, investor relations and other specialists in different departments and business units are dedicated to stakeholder engagement.

Internal stakeholder engagement is guaranteed by using various channels and platforms for informal and formal direct dialogue with and among employees.

As for the employee stakeholder group specifically, and in accordance with the Alpiq Code of Conduct and the company’s respectful and Secure Base Leadership-compliant behaviours, Alpiq adheres to the following principles:

ESRS 2 SBM-2 45 (a), SBM-2 AR 4

- Provision of appropriate working conditions (compliance with the applicable labour law at all times)

- No discrimination, and celebration of diversity (a dedicated Inclusion of Diversity team ensures that HR / workforce-related processes run according to inclusion standards)

- No bullying and no tolerance for harassment (performance management weights and assesses performance equally according to results and expected behaviours)

The purpose of internal stakeholder engagement is to foster commitment and motivation, which are crucial for running a successful business. In order to understand employees’ interests, needs and expectations, two employee surveys were conducted during the reporting period. The first survey was a short “pulse check” conducted in the first half of the reporting year, while the second one was a more extensive survey conducted in cooperation with the organisation Great Place to Work in the second half of the reporting year. The results of the first pulse check survey were published in the summer and some actions have been implemented as a consequence. The results of the survey conducted with Great Place to Work were published in January 2025 and actions based on the outcome are currently under development.

As for external stakeholder engagement, Alpiq is actively involved in professional associations through committees, commissions and working groups with the aim of working towards sustainable economic framework conditions for the Swiss electricity sector at political and administrative levels. The company is also in direct and continuous dialogue with political decision-makers (members of parliament, energy and environmental commissions) and government administration with the aim of mitigating and minimising risks and uncertainties in the political process. Alpiq continuously monitors and analyses political events and intervenes in specific legislative proposals to secure good framework conditions in the long term.

In addition, Alpiq works closely with NGOs, particularly in infrastructure projects and regarding the mitigation of environmental impacts, e.g. compensation measures related to Nant de Drance, which have been implemented in collaboration with WWF and Pro Natura.

The outcome of Alpiq’s stakeholder engagement is taken into account in various ways. For example, Alpiq has taken actions in response to the results of the pulse survey conducted in 2024. First, the desire expressed by employees for more clarity on the details of the company strategy was taken into consideration during the Targets 2025 EB workshop, by linking the strategy more clearly to daily activities and translating it into yearly goals. Second, a need to improve Alpiq’s meeting culture was identified. To achieve this, it was decided that a meeting guideline would be added by default to every meeting to enable more consistency and structure and make meetings more efficient and productive.

Furthermore, as previously mentioned, impacts on Alpiq’s own workforce are identified by means of regular surveys (conducted twice a year). The company strategy is adapted based on these impacts. One of Alpiq’s strategic pillars for organisational goals is based on people, and the outcome of the surveys is instrumental in setting related organisational goals. These goals help define actions to adapt the strategy and thus mitigate the negative impacts on the workforce. Progress towards the goals is continuously monitored to ensure that the workforce’s needs are properly addressed.

In addition, the interests and views of internal and external stakeholders were taken into consideration in the DMA. This was accomplished by conducting surveys and interviews with representatives of the relevant stakeholder groups.

Based on the surveys that were sent out and the interviews conducted with stakeholders as part of the DMA, the interests and views of Alpiq’s stakeholders and the engagement with these stakeholders can be summarised as follows:

ESRS 2 SBM-2 45 (b)

Stakeholder | Interests and views | Engagement |

Employees | Fair compensation Career growth Job security Work-life balance | Internal contact with employees is guaranteed through various channels and platforms for informal and formal direct dialogue with and amongst employees. In Switzerland, for example, Alpiq has a personnel committee in place that represents the employees’ interests towards the management of the Alpiq Holding AG. In addition, regular surveys (e.g., pulse checks and Great Place to Work surveys) are conducted, providing deeper insights into Alpiq employees’ interests and needs. Through various channels, e.g., through Alpiq’s SpeakUp mechanism, all employees can hand in cases of misconduct to be investigated internally by Alpiq’s Compliance team. |

Suppliers | Reliable payments Long-term relationships | Alpiq’s central procurement team for Switzerland and Prague maintains regular dialogue with suppliers. The dialogues conducted in other Alpiq locations are maintained in a more decentralised manner by Alpiq’s local Procurement specialists. |

Customers | Increasingly require sustainable business and a clear commitment to the reduction of negative impacts on environment and society as a condition for closing a deal | Customers were consulted in the creation of Alpiq’s DMA and their interests are recorded and represented by Alpiq’s employees in Sales & Origination. Alpiq’s SpeakUp tool is also open to the public, allowing customers to hand in compliance concerns for internal investigation. |

Business partners | Long-term relationships | Important business partners for Alpiq are the co-owners of the “Partnerwerke” constructs, pertaining mainly to Alpiq’s hydro power plants. Close collaboration and dialogue is maintained with said co-owners. |

Shareholders | Profitability Long-term growth | Dialogue is maintained via the Secretary of the Board and Annual General Meetings and through contact with the BoD. In addition, shareholders were consulted in the creation of Alpiq’s DMA. |

Banks | Financial stability Low-risk investments Increasingly interested in investing in companies with clear decarbonisation targets and paths | Dialogue is maintained through regular exchange between the Lead Group Sustainability and Alpiq’s key banks. Banks were also consulted in the creation of Alpiq’s DMA. |

Associations | Advocacy for industry issues | Alpiq is actively involved in professional associations through committees, commissions and working groups with the aim of working towards sustainable economic framework conditions for the Swiss electricity sector at the political and administrative levels. |

Politicians/government groups | Regulatory compliance Environmental protection Ensuring security of supply (e.g. Federal Act on a Secure Electricity Supply in Switzerland) | Alpiq is also in direct and continuous dialogue with political decision-makers (members of parliament, energy and environmental commissions) and government administration with the aim of mitigating and minimising risks and uncertainties in the political process. Alpiq continuously monitors and analyses political events and intervenes in specific legislative proposals to secure good framework conditions in the long term. |

NGOs | Minimising environmental/social impacts Ethical business practices | Alpiq works closely with NGOs, particularly in infrastructure projects and in connection with the impact on the environment (e.g. close cooperation with WWF and Pro Natura in the area of compensation measures relating to Nant de Drance). In addition, NGOs were consulted in the creation of Alpiq’s DMA. |

In addition to the stakeholder engagement activities described above, regular exchanges between the Lead Group Sustainability and various stakeholder groups (e.g. banks, investors, NGOs) take place to understand the stakeholder’s interests and needs. The Lead Group Sustainability represents their needs in the EB and NRSC meetings and provides support by ensuring alignment of the strategy with those needs. Some interests that have already been taken into account from these stakeholder groups include the following:

- Investors’ interest in reduced Scope 1 and 2 emissions, since these emissions appear in their Scope 3 balance.

- Banks’ increasing interest in companies with low CO2 emissions, as they have set thresholds to decarbonise their portfolios or accept gas investments only if there is a link to renewables development.

- NGOs’ negative perception of companies that operate with fossil fuels. This is a critical issue for Alpiq, since NGO support for new projects is essential. Alpiq took these interests into consideration when formulating the net-zero targets for Scope 1 and 2 as part of its strategic direction until 2040.

Alpiq is currently defining clear guidelines for sustainability transition plans, actions and targets in alignment with its strategy, in which the interests and views of stakeholders play an important role. These guidelines will be completed in 2025, and the resulting transition plans, actions and targets will be integrated into the Sustainability Report 2025.

While Alpiq’s corporate strategy, introduced in 2023, makes sustainability an integral part of all strategic decisions, no sustainability-related amendments have been made to the corporate strategy since 2023. The sustainability-related transition plans, actions and targets that are currently under development will be integrated into Alpiq’s strategy and will have a positive impact on stakeholders’ views and interests.

ESRS 2 SBM-2 45 (c)

Stakeholders’ views and interests with regard to the company’s sustainability-related impacts are provided to the BoD, EB and NRSC by the Lead Group Sustainability in the form of regular written or oral information.

ESRS 2 SBM-2 45 (d)